A gravestone doji is a trading pattern that occurs in technical analysis. It is a bearish trend that indicates a reversal is on the horizon. Traders can assume that the reversal will be accompanied by a downtrend in the security’s price.

The Gravestone Doji is a candlestick pattern that appears in financial market technical analysis. This pattern can be useful in forecasting future price fluctuations for investors and traders. The Gravestone Doji gets its name from its shape, which is shaped like a gravestone and has a long upper shadow and very little or no lower shadow. The Gravestone Doji is a single candlestick pattern that signals a trend reversal. It is one of the different types of the famous Doji candlestick pattern and is usually formed at the end of an uptrend.

How to Practice the Gravestone Doji

As such, it is said that those who come and buy at a higher price than this will die and become ghosts. Harness the market intelligence you need to build your trading strategies. From beginners to experts, all traders need to know a wide range of technical terms.

- These products may not be suitable for everyone, and it is crucial that you fully comprehend the risks involved.

- With the knowledge from this complete gravestone doji guide, you have an advantage.

- This means a doji can be classified as both a reversal and a continuation pattern, as it signals there is no firm outcome of who has control over the price action.

- Our reasoning is that the stock market moves extremely fast, and you may not have the luxury of waiting on a bigger move.

If you like our free indicators and EAs, kindly consider buying a product to support our work. Oscillators signaling overbought or oversold conditions reinforce gravestone doji reversal potential at extremes. If momentum is waning before a top reversal or building before a bottom reversal, it adds confidence to the signal. Sellers unload positions to book profits or cut losses near support.

How to Identify and Use the Gravestone Doji Candle Pattern in Forex Trading?

We recommend that you split the day into two or three halves, and see how the pattern performs on each. If you spot any significant differences, you may decide to not take a trade during the worst-performing time window. If a candlestick doesn’t have either a top or a bottom wick, that means that its opening or closing price https://g-markets.net/ was identical to either the highest price or the lowest price during the day. Candlesticks usually have thin lines extending from both the top and bottom of the real body. These are referred to as wicks or shadows, and the top of the top wick lines up with the highest price the stock achieved during the course of one day.

A big part of a trader’s success is the ability to technically analyze assets. In this article, you’ll learn what technical analysis is and how you can use it to identify new trading opportunities. The Harami pattern is a 2-bar reversal candlestick patternThe 2nd bar is contained within the 1st one Statistics to… HowToTrade.com takes no responsibility for loss incurred as a result of the content provided inside our Trading Room. By signing up as a member you acknowledge that we are not providing financial advice and that you are making the decision on the trades you place in the markets.

Using a Doji to Predict a Price Reversal

It can hint that the price is about to fall, especially if it appears after one long uptrend or near a resistance line. The gravestone pattern can be used as a screening filter in ChartMill. To do so, open the TA indicators menu on the stock screener page and open the drop-down menu under ‘candlestick’. It looks like an upside-down version of the Gravestone and it can signal a coming uptrend. Second, another approach of using the gravestone doji is to use it with pending orders. A pending order basically tells a broker to initiate a trade only once a certain price is reached.

- In financial charts, the Gravestone Doji trend is a bearish reversal trend.

- Of its variations, the dragonfly doji is seen as a bullish reversal pattern that occurs at the bottom of downtrends.

- The wide trading range combined with the close near the lows hints the trend is culminating.

- The Doji candlestick pattern may not provide the strongest buy or sell signals in technical analysis, and should likely be used alongside other metrics.

In the world of technical analysis, candlestick patterns play a crucial role in helping traders identify potential trend reversals and market movements. To determine entry and exit points, you should monitor key levels such as support and resistance levels and the level of the Gravestone Doji’s long upper shadow. The best entry presents when the pattern forms after a rally in a downtrend. In that case, you are combining the bearish reversal signal with an existing downtrend. If the pattern forms around a resistance level, the signal becomes even stronger.

What is a Convergence in Trading? Strategies and Risks

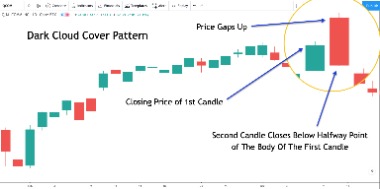

It occurs when the opening, low, and closing prices are all situated close to one another. Traders can use the Gravestone Doji pattern as a signal to initiate short positions, and these signals are even stronger when they appear at the conclusion of a previous uptrend. If gravestone doji candlestick pattern trading in stock markets, traders might also look at price patterns in conjunction with volume levels. However, traders in commodities markets, cryptocurrency markets, or foreign exchange markets can also use this powerful chart pattern when trading on any time horizon.

If the Gravestone appears after a pricing downtrend, it can indicate that a price increase may follow (a bullish sign). However, since this occurrence is rare, most traders will typically wait until the following day to verify the possibility of a price uptrend after a Gravestone. A doji is a trading session where the security’s opening and closing levels (or prices) are either equal or virtually equal. The Gravestone Doji candlestick pattern is pretty common on price charts.

In the image above, we outline the trigger line that shows the exact moment when you should short the stock after identifying the doji candle. Once a candle closes below this level, you can open a short position. Note the attempt to rally here, only for bears to quickly reassert their dominance in the downtrend. Markers like this can offer opportunities to add to short positions with confidence as you manage the down-trending trade. The Gravestone Doji candlestick pattern is formed by one single candle.

Sorry bulls but my bearish signals are firing – Raging Bull – RagingBull

Sorry bulls but my bearish signals are firing – Raging Bull.

Posted: Tue, 29 Aug 2023 20:07:07 GMT [source]

As a category, they are best described as a transitional pattern rather than a reversal or continuation pattern. Specific types of Doji patterns – like the Dragonfly or the Gravestone – can signal a possible reversal in prices but are best used in conjunction with other indicators for verification. In this example, the gravestone doji could predict a further breakdown from the current levels to close the gap near the 50- or 200-day moving averages at $4.16 and $4.08, respectively. The market narrative is that the bulls attempt to push to new highs over the session but the bears push the price action to near the open by the session close. On the other hand, when the gravestone doji happens in a bearish trend, the price opens at a lower level, attempts to recover, and then close at the opening price.